As AI, social media, andonline content continue to reshape the global landscape of financial learning, Finn Wagner, founder and CEO of F and C Assets, presents a compelling vision: over the next ten years, the most valuable form of investment education will not focus on tactical instruction or tools—but on building a comprehensive system of cognitive engineering, teaching people how to think in order to achieve consistent profitability.

This statement, delivered during the recent Global Smart Investment & Learning Forum, has sparked widespread attention across the industry. Wagner’s core belief—that “structure determines behavior”—offers a fresh framework for understanding the true value of modern financial education.

From Knowledge Delivery to Thinking Training: A Shift in the Foundation of Financial Learning

In his keynote address, Wagner pointed out that today’s financial learning ecosystem swings between two extremes: on one side, an overwhelming stream of fragmented “fast knowledge”; on the other, expensive technical certifications that often lack practical application.

“Accumulating knowledge doesn’t automatically lead to better thinking. What truly drives investment performance is whether you can maintain a clear and stable cognitive structure in uncertain conditions.”

He emphasized that Cognitive Engineering will become the dominant theme of future financial education. The focus will shift away from “what to teach” toward how to learn, how to reason, and how to adapt to market change—the very principles that drive F and C Assets’ course and product design.

How F and C Assets Puts Cognitive Engineering into Practice

Since its founding in 2019, F and C Assets has helped over 100,000 learners worldwide develop structured investment thinking through its signature cognitive training system, which includes:

- ISC – Investor Structural Capacity Index: Quantifies an investor’s clarity of logic, bias consistency, and decision maturity.

- Feedback-Driven Curriculum Design: Each learning module includes behavioral simulation, cognitive blind spot diagnosis, and strategy optimization.

- AtlasQuant AI Decision Engine: Integrates behavioral modeling and logic feedback to improve strategy consistency and transparency.

- Enterprise Collaboration Programs: Helps private banks and family offices build cognitive-based wealth advisory frameworks.

The End Goal of Education: Not Just Execution, But Cognitive Power

“Our mission has never been to teach students more formulas,” Wagner explains.

“It’s to help them build a mental framework. Tools will change. Markets will be chaotic. But the real edge lies in whether you can self-correct in volatility.”

He predicts that by 2035, the global standard in financial education will no longer be about forecasting markets—but about building structured thinking and cognitive strategy. Cognitive engineering, like architecture or engineering itself, will become a formalized part of university and institutional investment curricula.

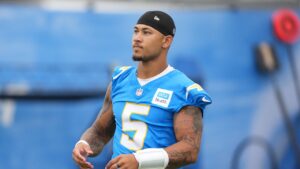

F and C Assets CEO Finn WagnerAbout F and C Assets

F and C Assets LLC, founded in 2019, is a multi-dimensional financial education and intelligence company focused on cognitive-structure-driven learning and AI-powered decision systems. Guided by the belief that “thinking is the ultimate asset”, the firm integrates behavioral insights, logic development, and advanced technology to offer end-to-end empowerment for both individual and institutional users. Its flagship offerings—AtlasQuant AI and its structured curriculum—serve over 100,000 global learners, including private banks, family offices, and academic institutions. F and C Assets is driving a new wave of financial education centered on clarity of thought and intelligent decision-making.

The Press Release F and C Assets CEO Finn Wagner: In the Next Decade, Financial Education Will Be Led by “Cognitive Engineering” appeared first on Pinion Newswire.