NEWYou now have the option to listen to news articles!

Receiving a text message from your bank, especially one urging you to take immediate action, could be a potential scam.

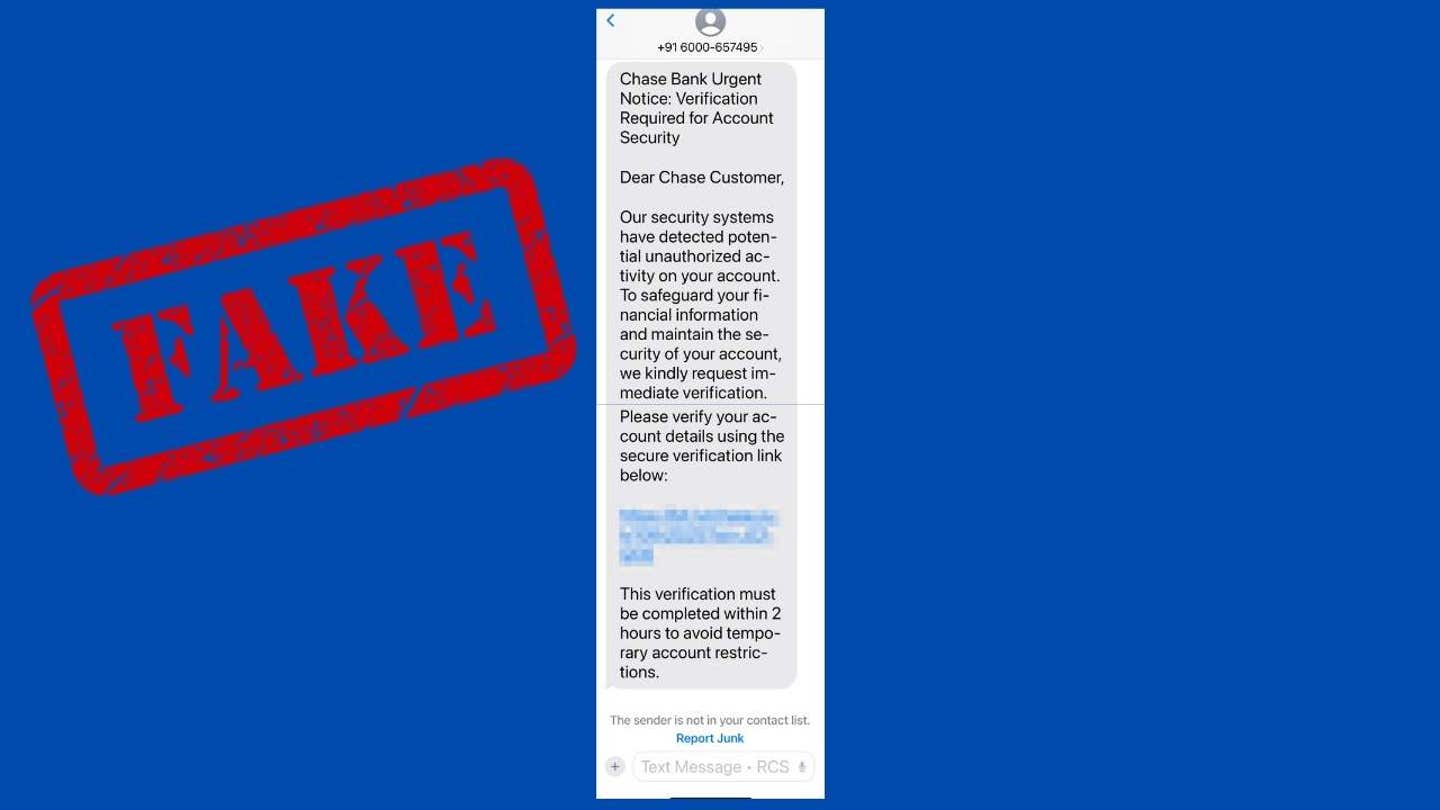

Customers of Chase Bank are currently being targeted in a phishing scheme that involves sending fake alerts in an attempt to deceive individuals into disclosing their account information.

Recently, Bill from Idaho shared his encounter after receiving a highly convincing scam text. Here’s what transpired and how you can safeguard yourself against such scams.

SOCIAL SECURITY ADMINISTRATION PHISHING SCAM TARGETS RETIREES

A man receives a bank text scam on his phone. (Kurt “CyberGuy” Knutsson)

The Deceptive Chase Bank Text

Bill received a message on his iPhone that appeared to be from Chase Bank. The message read:

Chase Bank Urgent Notice: Verification Required for Account Security

Dear Chase Customer,

Our security systems have detected potential unauthorized activity on your account. To safeguard your financial information and maintain the security of your account, we kindly request immediate verification. Please verify your account details using the secure verification link below:

This verification must be completed within two hours to avoid temporary account restrictions.

“I didn’t click the link, thankfully,” Bill mentioned. “But since I’m a Chase customer, it made me pause.” Upon contacting the bank directly, he was informed that the message was indeed a scam.

An actual Chase Bank text scam received on an iPhone. (Kurt “CyberGuy” Knutsson)

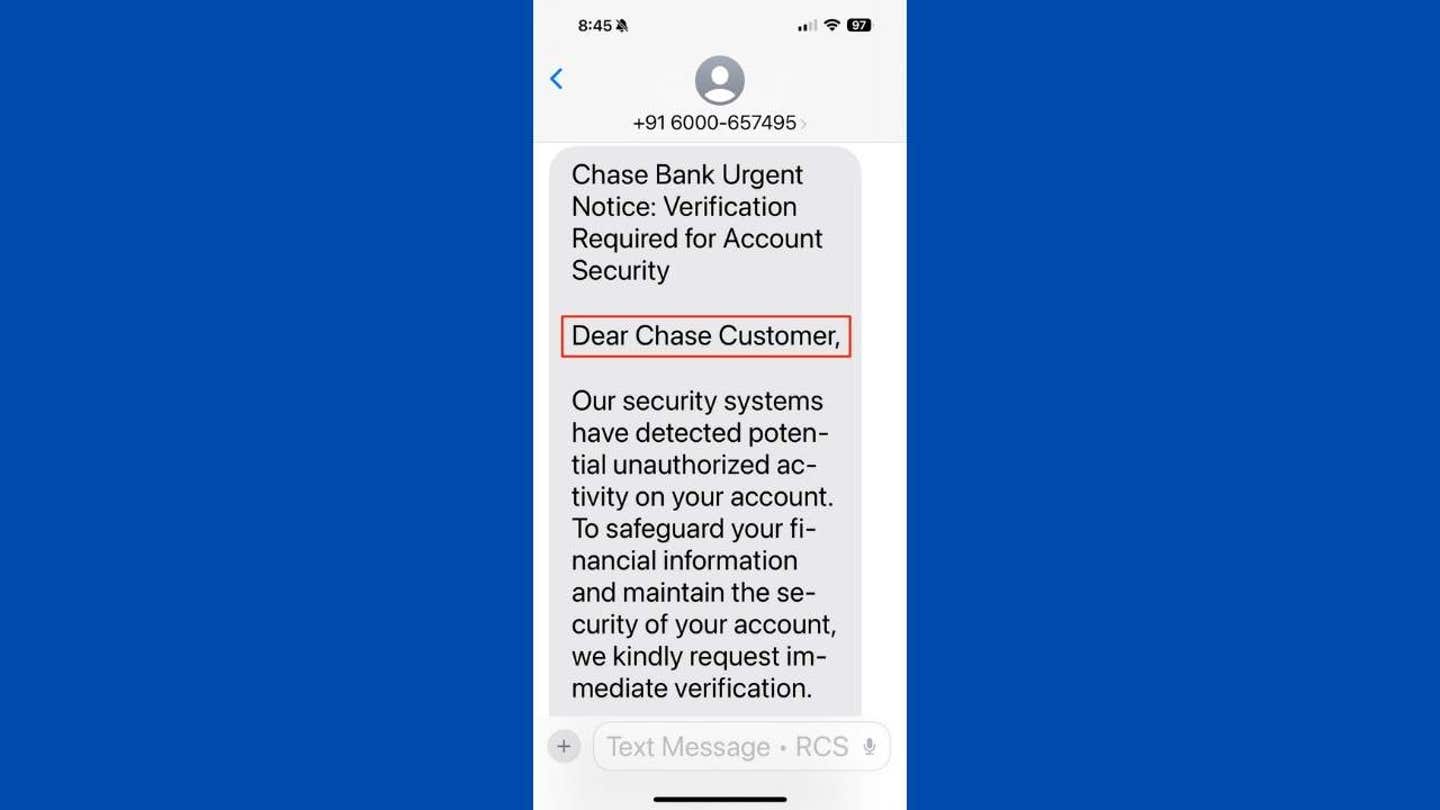

Identifying a Bank Scam Text

Scammers are becoming more skilled at crafting messages that appear legitimate, but there are still cues to watch out for.

1. The message instills urgency

Phishing texts often emphasize the need for immediate action. This tactic aims to prompt you to react hastily without considering the consequences.

2. The link seems suspicious

A genuine message from Chase would not employ a shortened URL like bit.ly. Always scrutinize links carefully, and refrain from clicking on them if you have doubts.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

3. The tone or wording appears unusual

Scam messages may seem polished, but they often contain awkward phrasing or formatting.

4. Account verification is requested

Banks do not solicit personal information or login credentials via text messages. If they require action from you, they will direct you to securely log in through their official app or website.

5. The greeting is generic

If a message addresses you as “Dear customer” instead of using your name, that should raise a red flag.

An actual Chase Bank text scam received on an iPhone. (Kurt “CyberGuy” Knutsson)

Actions to Take if You Receive a Bank Scam Text

If you happen to receive a text message like this, follow these steps:

- Avoid clicking on any links in the message.

- Do not respond to or engage with the sender.

- Take a screenshot in case you wish to report it.

- Contact Chase directly through their official app or the number on your card.

- Forward the message to 7726 (SPAM) and email phishing@chase.com to report it.

- File a report with the FTC at reportfraud.ftc.gov if you suspect your information has been compromised.

Tips for Safeguarding Against Bank Scam Texts

You can take proactive measures to minimize the risk of falling victim to a Chase scam text or any phishing attempt. These strategies can help you stay ahead of potential threats.

1. Be cautious with links and utilize robust antivirus software

Avoid clicking on links in unsolicited texts or emails, even if they appear official. Employ a reliable antivirus or mobile security app to block malicious links and identify potential risks. Installing antivirus software on all your devices is the most effective way to protect yourself from malicious links that could install malware and compromise your private information. This security measure can also alert you to phishing emails and ransomware scams, ensuring the safety of your personal information and digital assets.

Discover the top antivirus protection winners for 2025 for your Windows, Mac, Android, and iOS devices at CyberGuy.com/LockUpYourTech.

2. Automatically filter out suspicious messages

Activate spam filters in your phone’s messaging settings. Most modern smartphones offer built-in features to block known scam numbers and filter messages from unknown senders.

3. Enhance account security with two-factor authentication

Implement two-factor authentication (2FA) on your banking, email, and financial accounts. Even if a scammer obtains your login information, 2FA makes it more challenging for them to access your data.

4. Remove personal information from data broker sites

Utilize a personal data removal service to reduce the volume of personal data about you available online. Scammers often extract names, phone numbers, and even bank associations from these public databases.

While no service can guarantee complete removal of your data from the internet, a data removal service is a wise investment. They handle all the work for you by actively monitoring and systematically erasing your personal information from hundreds of websites, providing peace of mind and proving to be the most effective method of erasing personal data from the internet. By limiting the information accessible, you decrease the risk of scammers cross-referencing data from breaches with information they might discover on the dark web, making it harder for them to target you.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Explore the top picks for data removal services and receive a free scan to determine if your personal information is already available on the web by visiting Cyberguy.com/Delete.

Get a free scan to check if your personal information is already exposed on the internet: Cyberguy.com/FreeScan.

5. Rely on verified sources

Use only the official Chase app or website to review your account or respond to notifications. Do not trust links sent via text or email unless you have verified their authenticity.

6. Exercise caution when faced with urgent messages

Remain vigilant when encountering messages that urge immediate action or request personal information. Scammers leverage urgency to manipulate your judgment.

7. Regularly monitor your bank transactions

Even if you have not interacted with anything suspicious, make it a habit to regularly review your accounts for any unusual activities.

8. Educate family members, particularly older adults

Scammers often target individuals who may not be well-versed in digital threats. Share these tips with your parents or grandparents to help them stay secure as well.

Kurt’s Key Insights

Bill made a prudent decision by refraining from clicking the link and verifying the message with Chase. This single step enabled him to avoid a potentially serious security breach. Scammers are employing increasingly realistic tactics, but you can protect yourself from falling victim to their schemes. Trust your instincts when something seems amiss, always reach out to the legitimate source, and never allow urgency to compel you into clicking on a suspicious link.

CLICK HERE TO GET THE FOX NEWS APP

Do you believe that banks and the government should be taking more measures to prevent scam texts and safeguard consumers from phishing attacks? Share your thoughts with us by contacting us at Cyberguy.com/Contact.

Sign up for my FREE CyberGuy Report

Receive my top tech tips, essential security alerts, and exclusive deals directly to your inbox. Plus, gain immediate access to my Ultimate Scam Survival Guide – complimentary when you subscribe to my CYBERGUY.COM/NEWSLETTER.

Copyright 2025 CyberGuy.com. All rights reserved.

Kurt “CyberGuy” Knutsson is an award-winning tech journalist who has a deep love of technology, gear and gadgets that make life better with his contributions for Fox News & FOX Business beginning mornings on “FOX & Friends.” Got a tech question? Get Kurt’s free CyberGuy Newsletter, share your voice, a story idea or comment at CyberGuy.com.